child tax credit 2021 october

You should receive the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than. The Amount Of Credit You Receive Is Based On Your Income And The Number Of Qualifying Children You Are Claiming.

A Wisconsin Community S Beloved School Returns To Life With Help From Historic Tax Credits National Trust For Historic Preservation Tax Credits Oconomowoc School Building

October 29 2021 In October the IRS delivered a fourth monthly round of approximately 36 million Child Tax Credit payments totaling 15 billion.

. 112500 for a family with a single parent also called Head of Household. The child tax credits are worth 3600 for kids below six in 2021 3000 for those between six and 17 and 500 for college students aged 18 to 24. This payment is an advance and most families will receive half of their credit.

That means parents who. The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600 per qualifying child. This sent parents as much as 300 per child per.

But when the revamped provisions expired all those gains were lost and four-decade high inflation is expected to. The American Rescue Plan Act of March 2021 authorized the expanded Child Tax Credit. 150000 for a person who is married and filing a joint return.

The child tax credit was enhanced as part of President Joe Bidens American Rescue Plan signed into law in March 2021. For the last six months of 2021 families with eligible children received. October 14 2021 at 559 pm.

Under the American Rescue Plan the maximum child tax credit rose to 3000 from 2000 per child for children ages 6 and older and it rose to 3600 from 2000 for children ages 5 and younger. The American Rescue Plan Act expanded the credit increasing the amount of the credit from 2000 to 3600 for babies born in 2021. Families that receive too much may have to pay the difference back depending on their income.

Parents that had a child in 2021 can claim the child tax credit if they meet certain requirements. Ad The 2021 advance was 50 of your child tax credit with the rest on the next years return. The fourth advance child tax credits payment will land in bank accounts and as paper checks on October 15.

The Child Tax Credit reached 611 million children in October and on its own contributed to a 49 percentage point 28 percent reduction in child poverty compared to what the monthly poverty rate in October would have been in its absence. This fourth batch of advance monthly payments totaling about 15 billion is reaching about 36 million families. The fourth payment date is Friday October 15 with the IRS sending most of the checks via direct deposit.

The american rescue plan enacted in last march increased the tax break to 3000 from 2000 per child under age 17 with 600 more for kids under age 6. The enhanced Child Tax Credit for 2021 pulled millions of children out of poverty. The credit will be paid to families in 2021 and will be fully paid out in 2022.

October 13 2021 631 pm cbs boston. Half of the total is being paid as six monthly payments and half as a 2021 tax credit. Here is some important information to understand about this years Child Tax Credit.

IR-2021-201 October 15 2021. File a federal return to claim your child tax credit. The fourth monthly payment of the expanded Child Tax Credit kept 36 million children from poverty in October 2021.

Simple or complex always free. On top of stimulus cash many who had children also qualified for advanced monthly payments for the child tax credit. So parents of a child under six receive 300 per month and parents of a child six or over receive 250 per.

Bitcoin drops 400 monthly check car owners child tax credit 2022 ss. Thats an increase from the regular child tax credit of up to. CBS Detroit The fourth Child Tax Credit payment from the Internal Revenue Service IRS goes out tomorrow.

WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families are now receiving their advance Child Tax Credit CTC payment for the month of October. Child Tax Credit Norm Elrod. The IRS is relying on bank account information provided by people through their tax.

The Child Tax Credit provides money to support American families. The Child Tax Credit Non-Filer Sign-Up Tool is to help parents of children born before 2021 who dont typically file taxes but qualify for advance Child Tax Credit payments. Eligible families can receive a total of up to 3600 for each child under age 6 and up to 3000 for each one ages 6 to 17 for 2021.

H R Block Reports Revenue Growth In Fiscal 2021 Second Quarter Hr Block Revenue Growth Dividend

October Holidays 2021 Fun Unique Reasons To Celebrate So Festive National Holiday Calendar Holiday Calendar October Food

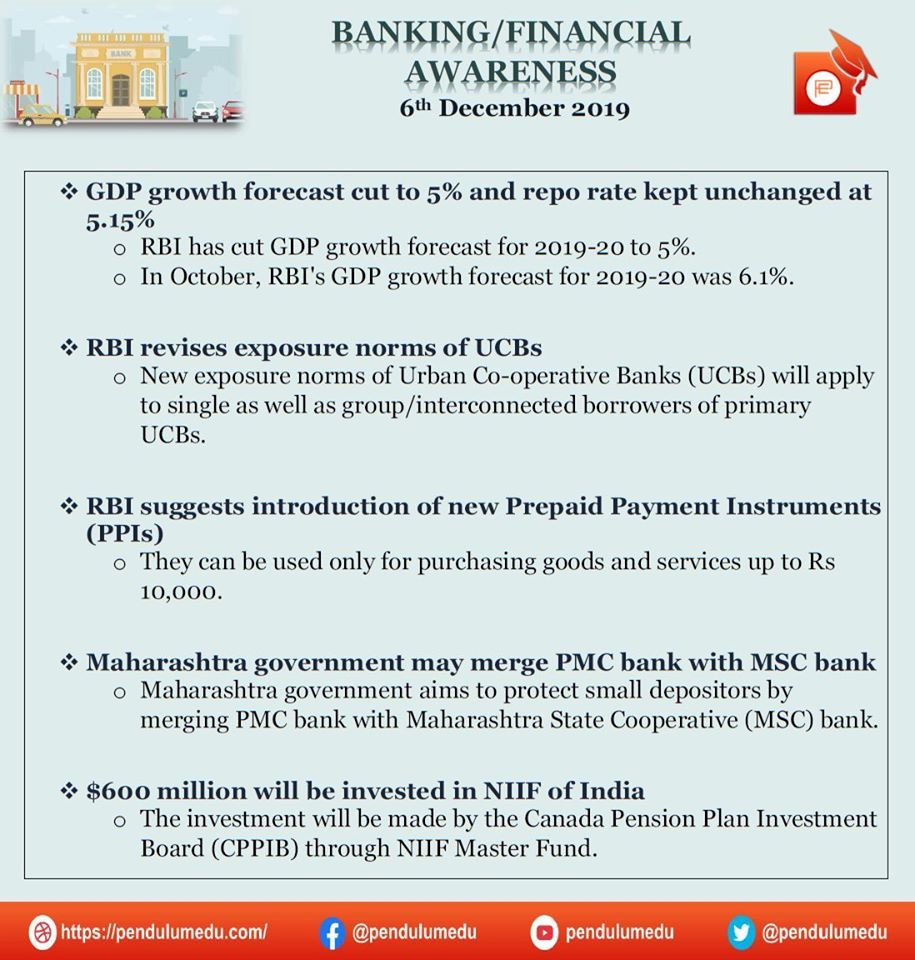

Daily Banking Awareness 06 December 2019 Awareness Financial Banking

Pdf Ebook South Western Federal Taxation 2021 Comprehensive 44th Edition By David M Maloney Ja Buy Ebook Ebook Online Taxes

Welcome You Are Invited To Join A Meeting Uplift Resume Building Workshop After Registering You Will Receive A Confirmation Email About Joining The Meeting In 2021 You Are Invited Resume Writing Workshop

Family Circus 4 15 10 Gif 320 367 Family Circus Family Guy Character

Pin By Tax Consultancy On Tax Consultant Tax Deductions Bank Statement 1st Bank

17 Dividend Stocks For Daily Cash Flow Cash Flow Energy Sector Dividend

The Independent Counselor Credit Counseling Counselors Counseling

Input Tax Credit Tax Credits Indirect Tax Tax Rules

Pin On Whatmommydoes On Pinterest

Tariff Rate Quota Based Export Of Sugar To Us Is Allowed By India Rate Export Raw Cane Sugar

Gst Input Tax Credit Tax Credits Indirect Tax Tax Guide

Tds Due Dates October 2020 Dating Due Date Income Tax Return